How Dr Timothy Clipsham started a family dental practice

Dr Timothy Clipsham always knew he wanted to become a dentist. He also knew he one day wanted to open his own family dental practice.

Learn More![]() 6.5 minutes

6.5 minutes

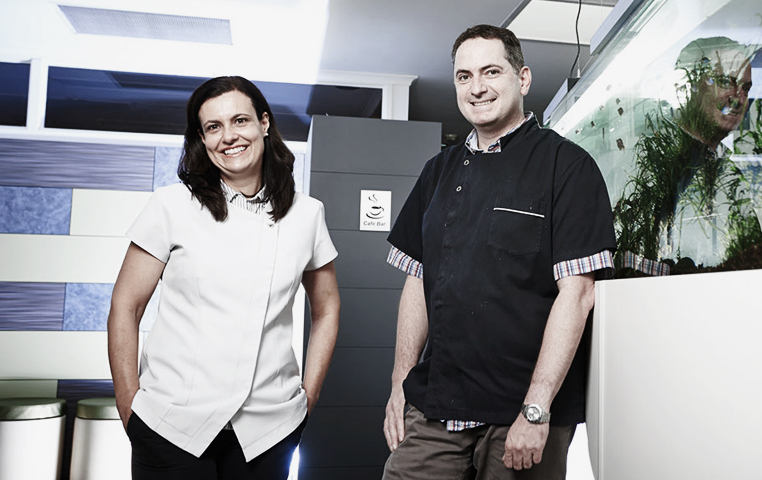

Since landing in Melbourne from Brazil two decades ago, Tarcilio and Silvia Cavalcante have been busy. They’ve raised a family, bought a couple of properties and helped build a successful outer-metro dental practice, Wyndam Dental Solutions.

“I bought half the business in 2004, then bought my partner out in 2014,” Dr Tarcilio Cavalcante says.

“Now Silvia and I own and run the practice, with our former partner as the third dentist.”

To buy out their practice partner, the Cavalcantes paid a fair amount of money. While they had paid much of the debt, it didn’t occur to them to seek personal finance as well. “It never crossed my mind,” Dr Cavalcante says. “Until my wife and I saw a house we really liked.”

And when that happened, they found it trickier than they expected.

When the Cavalcante family first arrived in Australia, they lived in Williamstown, “but the family was growing and we needed a bigger house,” Dr Cavalcante explains. “We found one in Sanctuary Lakes, but always talked about coming back to Williamstown.

“We weren’t thinking about it seriously until we saw this house up for auction. I put the numbers together and thought, ‘Maybe we’ll give it a go’. We didn’t have a lot of time—the auction was in two weeks. So I went to my bank [for] a loan. They sent a home-loan specialist in who looked at everything, then at the very last minute made us an offer that was impossible to accept.

“I’m not a big risk-taker, and they’d set it up in such a way that it was very risky for me, and didn’t give me many opportunities or much flexibility.”

That’s when Dr Cavalcante got in touch with BOQ Specialist.

“Many times before—when I’d bought my first house, and the practice—BOQ Specialist helped me. I sent a quick email asking for help and Lindsay Rose came and was more helpful than we could have imagined.”

Lindsay Rose, a financial specialist from BOQ Specialist, helped the Cavalcantes tailor a flexible finance plan that suited their business and family needs, gaining approval for bridging finance for a home worth up to $3 million, with the loan terms ensuring they had the six months’ breathing space they needed to sell their existing residence.

“It only took two weeks to get it all approved,” Dr Cavalcante recalls. “The first time we spoke to Lindsay was a fortnight before auction; she gave us the green light a day prior to auction.”

They didn’t get that first house but soon afterwards, found another. A month later, it was theirs. “It wasn’t as good as the initial house, but we bought it with the intention to do renovations, to make it what we wanted,” Dr Cavalcante says.

Paying off the business debt was a priority. “What I wanted to do was sell our house and use part of the money to pay the business debt off so I could focus on my new house,” he explains. “But my previous bank didn’t make it easy for me. The way BOQ Specialist structured our finances worked much better for us and made more sense.

“They said, ‘Yes, you could pay it off—but we can make it even better for you: we can keep the business loan as an interest-only [loan] for another few years and just pay the interest, which is tax-deductible, then either renegotiate the deal later or pay it off when you want’.

“We sold our old house and now have a significant amount in an offset account, so when the business loan expires we can pay it off. They made it more flexible for us, and more practical.”

According to Dr Cavalcante, BOQ Specialist could help because of their niche focus on medical and dental practices. They had the knowledge of how practice finances are set up normally, and could use that to benchmark the way the Cavalcantes worked.

“BOQ Specialist is very personal,” he adds. “I was only in touch with two people there, and both were always ready to help. Lindsay showed a lot of empathy: a willingness to do the best she could.

“Like right now; we’re finally going ahead with the renovations, so I spoke to Lindsay and again, they’re happy to help. We work together and have a very good commercial relationship.”

Meanwhile, the family are enjoying their new home. “We are very happy here,” Dr Cavalcante says. “We realised all our plans and made them happen in a very nice, if unexpected, way.”

Our bi-annual magazine which features case studies from our clients and gives you first hand examples of how we can help you to grow your business.

The information contained in this webpage is general in nature and has been provided in good faith, without taking into account your personal circumstances. While all reasonable care has been taken to ensure that the information is accurate and opinions fair and reasonable, no warranties in this regard are provided.